Are Auto Shows Nearing Extinction?

Focusing on consumers has given some events new life, but it might not be enough.

Porsche

Porsche

Post-pandemic, the 2022 North American International Auto Show (NAIAS) was a little underwhelming, with stretches of vacant floor where once stood majestic booths. Even before COVID-19 shuttered public events of all shapes and sizes, the mighty auto show was struggling to remain relevant. On the bright side, there were some signs that the show is changing its focus in a way that may ensure its survival. Namely, NAIAS organizers sought to make the event more of an experience rather than merely a showcase.

Tesla

Tesla

Evolution of Auto Shows in the U.S.

The first auto show in the United States took place in New York back in 1900, and for about a century afterward the template stayed very much the same: big consumer-focused events held in big halls packed with the latest and greatest cars and trucks, many shown to the public for the very first time.

As auto shows evolved, they grew to serve the media, consumers, and industry insiders. The automotive media went to see unveilings of next year's models pulled from beneath satin sheets to a fusillade of camera flashes. Consumers went in droves to shop — inspecting the cars, sampling the interiors, and maybe even lining up a test drive. Auto insiders went because leaders from across the industry were there, making the show a great place to schmooze with a new supplier, vendor, or agency.

"These shows have the automotive press on hand covering each product as it is revealed," said Tyson Jominy, vice president of automotive consulting at J.D. Power. "In the heyday of the global auto show, it would not be uncommon for 12 to 20 new models or concepts to be introduced at a single show."

In the past 15 years or so, though, that formula is starting to shift. The bedrock beneath the foundations of these long-running shows is crumbling as Apple introduced a more innovative model. Similar to automakers, Apple used to participate in big industry showcases like the now-defunct Macworld Expo. As the company grew in power and the internet opened new doors in the 2000s, it realized it didn't need outside help, nor did it need to share the spotlight with other companies. It could simply use its longstanding Worldwide Developers Conference to unveil its products and make big announcements on its own terms.

The massive success of these events shook the tech world, and others — including automakers — began to follow suit.

Tesla is the most notable example, holding private, flashy events for numerous vehicle debuts. It was the Model 3 launch in 2016 that raised eyebrows. Within a week, Tesla had hundreds of thousands of pre-orders for the car.

Then COVID-19 accelerated the shift to brand-centric events, influencing auto shows to make new plans. For instance, following several pandemic-related postponements, Ford decided to host an online launch of the revived Bronco. It received more than 150,000 reservations basically overnight, far exceeding the automaker's expectations and proving that manufacturers can get all the buzz they need on their own.

Porsche

Porsche

Where We Are Now

The reduction of new-model reveals has led to a reduction in media presence at auto shows. If there's nothing newsworthy to report from a big show, there's little justification to send a team of journalists to cover it.

Likewise, if a brand like Volkswagen or Porsche has nothing to unveil, putting together a show-stopping booth and displaying the full lineup on the floor often isn't worth the expense.

"Instead of the multistory displays of the past, the feeling of the show was very flat," Jominy said. "It was possible to see from one wall of the convention center to the other. In recent years, one could barely see beyond the display they were currently in. Each of these displays costs in the millions, and automakers have used that money more efficiently on their own events that are taking place at a time and location of their choosing."

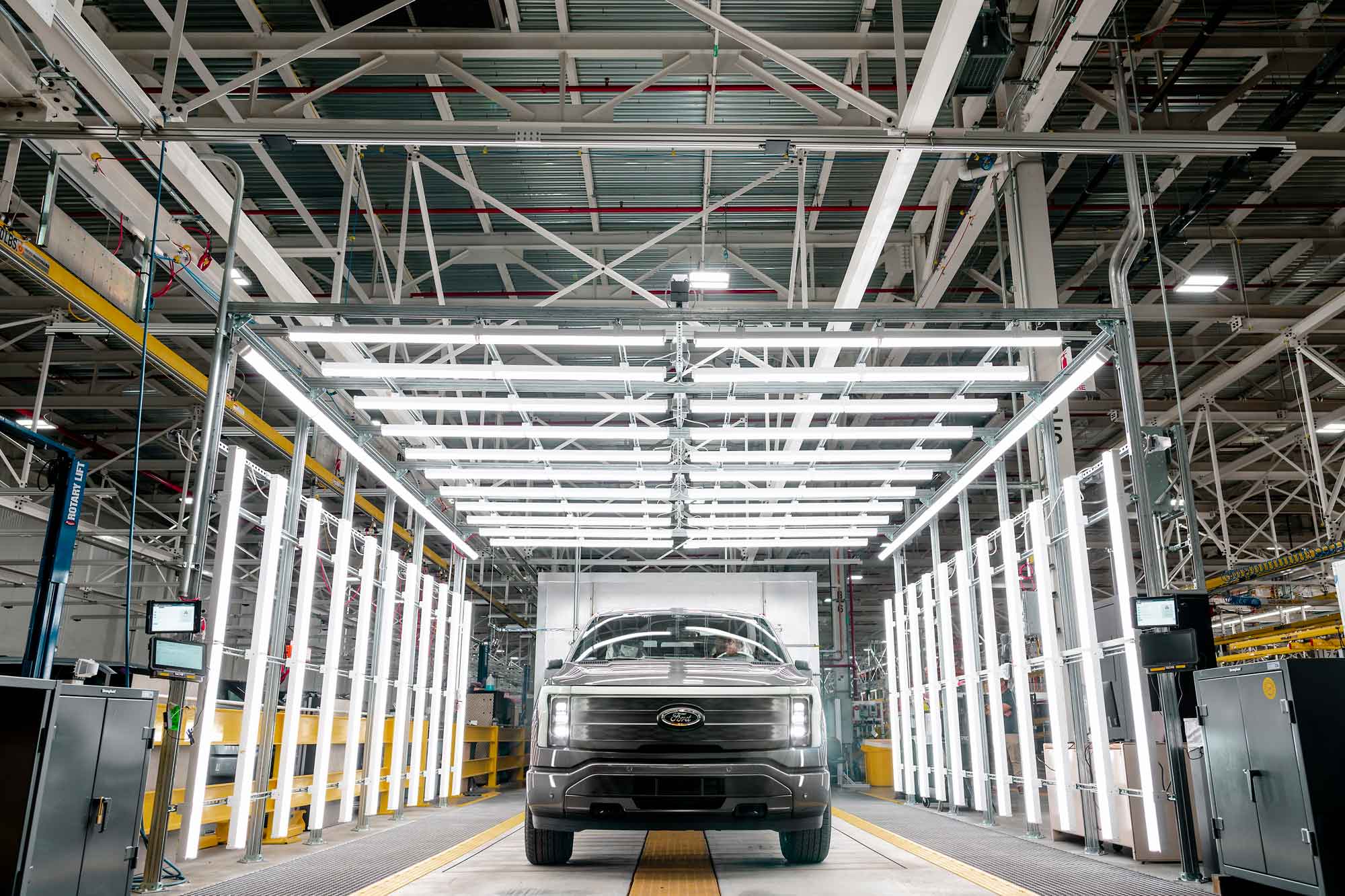

Ford

Ford

Plans for the Future

The lack of automaker participation (and the resulting abundance of space) has reduced the fanfare, but it has also created some interesting opportunities. On the NAIAS show floor, Ford and Ram are able to set up large test tracks, where attendees can experience everything from acceleration runs in an F-150 Lightning to simulated rock crawling in a Bronco. For a customer thinking about buying one of those vehicles, NAIAS can make for a compelling stop.

Jennifer Morand knows a thing or two about engaging the public at these kinds of events as president of the Chicago Automobile Trade Association and general manager of the Chicago Auto Show, which often features interactive exhibits that get showgoers inside cars and on the move.

"People want to experience these vehicles," Morand said. "In fact, 40% of attendees at our show in 2022 and 2021 experienced a test track or took a test drive. … We had a record six indoor test tracks — including a first-time indoor EV track — as well as outdoor ride-and-drives."

While more customers are configuring and ordering cars online, sight unseen, there's still value in the traditional test drive. Auto shows are positioning themselves to become a great venue for that.

"The opportunity for consumers to actually see the car, walk around it, sit in it, and check it out six ways from Sunday is essential to the shopping and buying process," said Tim Jackson, who oversees the Denver Auto Show as CEO and president of the Colorado Automobile Dealers Association. "And consumers are able to repeat that with literally hundreds of cars by walking across one the largest showrooms possible with competing brands on the same floor."

While the consumer impact of auto shows remains strong, when it comes to major car launches Morand is pragmatic about the evolving position of the auto show.

"The interest is there from automakers. That said, we're happy to augment their digital introductions with their presence at our show," Morand said "We continue to work with them hand in hand to help amplify that news, whether that's in person at our show or online via social media."

Written by humans.

Edited by humans.

Tim Stevens

Tim StevensTim Stevens is a veteran editor, analyst, and expert in the tech and automotive industries. He helmed a major website's automotive coverage for nine years and acted as its content chief. Prior to that, Tim served as the editorial lead at a tech-oriented site and even led a previous life as an enterprise software architect.

Related articles

View more related articles