Online bill pay: What it is, how it works and why use it

Keeping track of your bills can be a hassle. Remembering due dates for rent, utilities and credit card payments and how to pay each one can be a challenge. And despite your best efforts, sometimes things can slip through the cracks.

The last thing anyone needs is to get a late fee over a simple mistake. Luckily, online bill pay can help you stay organized and pay your bills on time. But how does online bill pay work and how do you set it up? What are the pros and cons of online bill pay? Keep reading to find out the answers to these questions and more.

What you’ll learn:

-

Online bill pay is a service your bank may offer that you can use to pay your bills.

-

You can set up recurring or automatic payments to ensure your bills are paid on time.

-

Setting up online bill pay is easy and can typically be done by accessing your online account through your bank’s website or mobile app.

-

Online bill pay is a convenient way to make and manage bill payments all in one secure location.

What is online bill pay?

Online bill pay is a type of digital payment service that financial institutions offer that can make it easier to electronically manage and pay your bills using online banking. If your bank offers it, you can use online bill pay to pay your credit card bills, subscriptions, utility bills and more.

Instead of paying each bill on a separate website, you can use online bill pay to manage your bills in one place. And you can set up various notifications, one-time payments, recurring payments or automatic payments so you don’t miss any due dates.

How does online bill pay work?

To use online bill pay, you provide your bank with the information for the service provider you want to pay. You indicate the amount to pay and, if it’s a recurring payment, the schedule to follow for payments. Then your bank will pay the bill using funds from your account.

Online bill pay typically has to be linked to a checking account or debit card. That’s because you usually can’t pay off a loan with another line of credit. Keep in mind: Some types of bills—like mortgage and auto loan payments—typically can’t be paid with a credit card at all. And you can’t directly pay off one credit card with another either.

Online bill pay vs. automatic payments

According to the Consumer Financial Protection Bureau (CFPB), automatic payments work differently from recurring online bill pay. When you set up recurring online bill pay, you’re giving permission to your bank or credit union to send the payments to your billers. But when you enroll in automatic payments, you’re allowing the company that issues the bill to take payment from your account.

How to set up online bill pay

How you set up and use online bill pay might vary by financial institution. But it’s usually a simple process that you can complete through your online banking account or mobile banking app.

Typically, you can follow these general steps to set up online bill pay:

-

For each bill, you’ll likely need to enter some of the merchant’s or service provider’s information. So it’s a good idea to have a copy of each bill on hand when you enroll.

-

Sign in to your account.

-

Select the bill pay page and follow the steps as prompted.

-

Choose the payment schedule and the amount you want to pay. You may be able to set up one-time or recurring payments.

Once online bill pay is set up, your bank sends scheduled payments to the biller. If you need help setting up online bill pay, you can contact your bank for guidance.

How to set up online bill pay with Capital One

You can use Capital One online bill pay as an alternative way to make your normal check, automatic debit or cash payments to anyone in the United States.

Here’s how you set up online bill pay with Capital One:

-

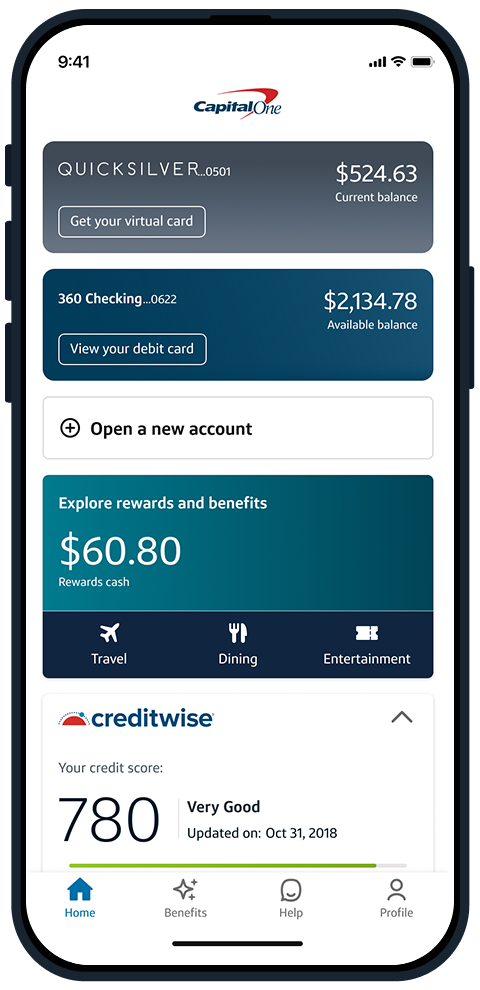

Sign in to your Capital One account online or through the Capital One Mobile app.

-

Select the account you want to pay from.

-

Select the Pay Bills option if you’re using the app or the Bill Pay option if you’re using the web.

-

Read and accept the terms and conditions.

-

Locate the vendor’s name or add a new payee and follow the steps to set up an online payment.

-

If you want to set up scheduled or recurring payments, simply select Payment Options in the Pay Bills section of your account.

Why use online bill pay?

Here are some of the benefits of online bill pay:

-

Convenience: Online bill pay lets you schedule payments in advance. You can set up one-time payments, recurring payments or automatic payments. Plus, you can pay all of your bills in one place, which may make it easier to stay organized.

-

On-time payments: Setting up recurring or automatic payments may help you avoid late or missed payments. And this could help you keep your accounts—and, over time, your credit scores—in good standing.

-

Sustainability: Paying your bills online can help eliminate paper waste.

-

Security: With online banking, you don’t have to worry about your payments being lost or stolen in the mail. And paying online could protect you from phishing scams or identity theft. That’s because you typically use your bank’s secured website to make online payments.

How online bill pay works FAQ

Still want to know more? Here are the answers to some frequently asked questions about online bill pay.

Is online bill pay safe?

Financial institutions typically have many measures in place to protect digital fund transfers like online bill pay. These measures can include password-protected login and file encryption.

Online bill pay can also make it easier to stop unintended payments and verify a payment if a biller claims you didn’t pay. But it’s still a good idea to be cautious anytime you give out your bank account information.

And if you want to know how Capital One helps you protect your money, you can learn more about Capital One’s fraud and security features.

Are there any disadvantages to online bill pay?

There are some potential downsides to online bill pay you should be aware of. For instance, if your account doesn’t have enough money to cover your bills, the payment may not go through or you could be charged overdraft fees. Capital One has completely eliminated all overdraft fees for its consumer banking customers while continuing to provide overdraft options.

It’s helpful to keep enough money in your account to cover your bills. And if you set up recurring payments and the bill amount changes, you might end up paying the wrong amount. That could lead to fees or other penalties.

How long does it take for bill pay to go through?

Payments made with online bill pay take time to process. The time it takes to process online payments might depend on your financial institution, the vendor’s processing time and other factors.

The CFPB says that when you schedule a payment with online bill pay, most banks will show you how much time is required to process the payment. And if your account doesn’t have enough money to cover the payment, it might be delayed.

Do banks charge for online bill pay?

Banks don’t typically charge for using their online bill pay service—it’s generally free for account holders to use. Capital One provides its online bill pay service to customers free of charge.

Key takeaways: Online bill pay

Online bill pay can be a great way to stay on top of your bills, schedule payments ahead of time and cut down on paper waste while you’re at it.

For Capital One customers, using online bill pay is easy and convenient. If you’re ready to get started, download or log in to the Capital One Mobile app today.